ISPE Global Pharmaceutical Innovation Survey Findings: A Review

In 2023, ISPE launched an expansive and significant initiative, Enabling Global Pharmaceutical Innovation: Delivering for Patients, to address the barriers to technological innovation in the pharmaceutical industry. The first activity of the initiative was to conduct a three-part survey of ISPE members to understand the circumstances and confirm the sources that create barriers to innovation.

The rationale for this initiative is given in an iSpeak blog, “ISPE Launches Enabling Global Pharma Innovation: Delivering for Patients,”1 which was published as part of the initiative’s launch. In late 2022, ISPE assembled a team of industry leaders with expertise in advancing innovative technology and products and with experience in addressing regulatory divergence.

This ISPE team developed a comprehensive survey to understand the specific origins, extent, and magnitude of challenges and barriers that limit and reduce both the development and implementation of innovative technologies. A full report of the survey was published in April 2024 on the ISPE website.2

Background

Regulatory authorities globally have embraced technological innovation to improve product quality assurance, accelerate product development, rein-force supply chain reliability, and increase patient access to medicines. Several regulatory authorities—including the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the United Kingdom’s Medicines and Healthcare Products Regulatory Agency (MHRA)—have actively promoted the adoption of innovative and advanced pharmaceutical manufacturing technology. They have done this by introducing regulatory options that enable industry to develop and implement advanced manufacturing technologies.

Although it is incumbent upon industry to modernize manufacturing processes to improve productivity and increase confidence in product quality assurance by introducing novel technology and modalities, economic and regulatory barriers discourage the development and implementation of new, innovative technology globally. Perhaps most significantly, the conspicuous lack of global regulatory harmonization reduces incentives for industry to invest in innovations, which indirectly limits access to safe, effective, and quality drug products to patients globally.

The Initiative

This initiative is consistent with ISPE’s mission and vision3 and is aligned with the advancement of ISPE’s Pharma 4.0™ program.4 It aims to catalyze consistent, harmonized interpretation and implementation of the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) guidelines to improve global patient access to innovative medicines and technology.5

The phrase “enabling pharmaceutical innovation” encompasses technical innovations in pharmaceutical manufacturing and analytical technology, the introduction of new medical modalities, modes of delivery and administration of medicines, and digital transformation (Pharma 4.0™). The phrase “delivering for patients” addresses improved assurance of product quality, supply consistency and reliability, improved product convenience and use, expedited patient access globally, and, where applicable, improved productivity and reduced manufacturing costs.

Seven pivotal objectives describe the scope of the initiative:

- Contemporize manufacturing technologies, i.e., advanced modeling and simulation, digitalized technologies

- Reinforce globally harmonized interpretation and implementation of ICH guidelines necessary to advance innovative technology and industry approaches such as Pharma 4.0™, establishing criteria for a globally accepted drug product control strategy

- Identify sources of regulatory challenges that are barriers or create limitations in applicability across multiple therapeutic modalities

- Increase the level of clarity and consistency in harmonized approaches and identify and promote incentives for implementation of innovative technology

- Leverage relevant regulatory harmonization initiatives and convergent regulatory approaches that are in progress regionally, and accelerate the adoption and implementation of ICH guidelines and other harmonization proposals, i.e., mutual reliance/recognition as promoted by the International Coalition of Medicines Regulatory Authorities (ICMRA), World Health Organization (WHO), and Pharmaceutical Inspection Co-operation Scheme (PIC/S)

- Identify incentives for regulatory authorities to collaborate

- Assess learnings from the COVID-19 pandemic, where global regulatory and supply distribution experience can serve as a roadmap, i.e., mutual reliance, parallel development, regulator engagement

Survey Design

The survey consisted of three parts, with the option to respond to all or any of the parts. Part 1 was a list of questions requiring simple multiple-choice answers focused on demographics and summary-level innovation experience. Part 2 requested brief but specific examples of innovation development experience. Part 3 requested more detailed information and, where appropriate, anecdotal examples and case studies describing innovation challenges. The survey launched in April 2023 and closed on 12 December 2023.

Summary of Survey Findings

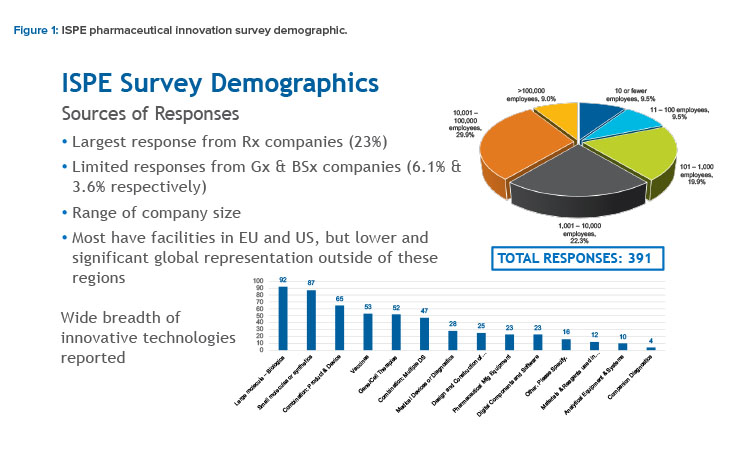

Responses to the survey were relatively high (391 respondents) and reflected a representative sector of the pharmaceutical industry. This included a diverse mix of large to small pharmaceutical manufacturers, contract manufacturing and development organizations, component and equipment suppliers, and facilities and software service providers located in multiple countries and reflecting multiple product modalities (see Figure 1).

Although the majority of responses came from innovator (brand name) companies (23%), a small proportion of responses came from companies responsible for manufacturing generic products (6.1%) and biosimilar products (3.6%).

Embracing Innovative Technologies

Companies manufacturing generic products were asked, “If you are a supplier or manufacturer of generic products, do your partners/clients embrace innovative technology? Why or why not?” Generally, respondents (22) indicated that companies manufacturing generic products do not embrace new technology mainly due to economic factors and the risk of disrupting supply chains. Several companies and partners to companies manufacturing generic products indicated, however, that some companies do embrace new technology when the business case supporting cost reduction is strong.

Respondents also identified a variety of product types for which they were responsible. These included large and small molecules, combination products and vaccines, medical devices, and companion diagnostics, as well as vendors of manufacturing and analytical equipment, components, and facilities; digital software; process materials; and reagents (see Figure 1).

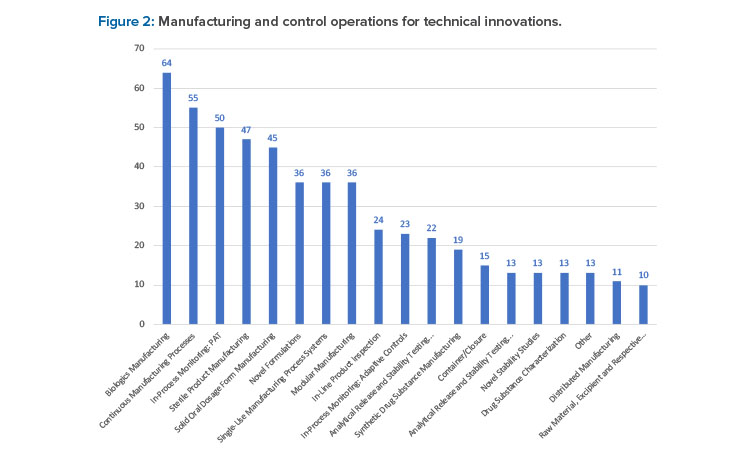

From this broad cohort of companies, 545 wide-ranging innovations were reported. Biologics manufacturing (11.7%), continuous manufacturing processes (10.1%), and in-process monitoring process analytical technology (9.1%) were the top innovations reported (see Figure 2).

Of these innovations, not all were submitted in regulatory applications for approval. However, a wide range of innovative technologies, most notably with respect to biologics manufacturing (13.5%) and novel product formulations (11.0%), were submitted in regulatory applications predominantly in the US (21.8%) and the European Union (EU) (18.3%), with fewer application submissions in the other geographic regions globally.

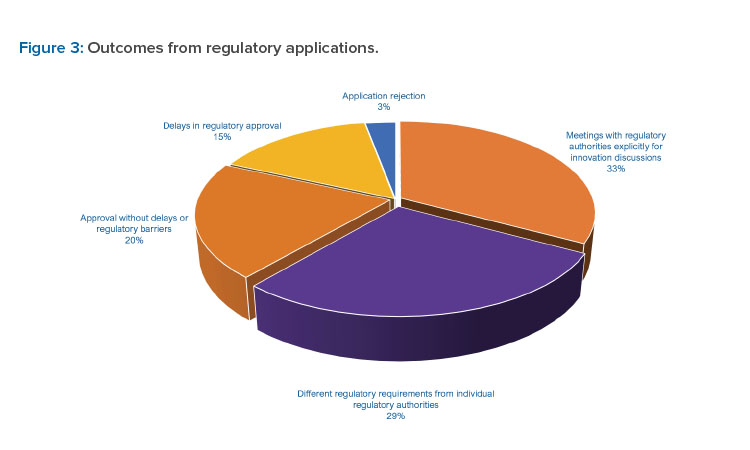

Respondents reported a range of experiences with submission of applications for innovative technologies. A number of responses indicated their applications for innovative technologies were approved (20.4%). However, different regulatory expectations from individual regulatory authorities (28.5%) and delays in application assessments/inspections (15.3%) also were reported. A relatively low number of rejections (2.9%, or 4 of 152 reported) indicate that regulatory authorities have generally accepted applications containing innovative technologies (see Figure 3).

Investment Considerations

When determining cost and benefit for capital investment, in general, respondents indicated that economic factors were the primary drivers. The potential for long-term revenues and the anticipated efficiency or productivity (ranked as the top factor by 33.6% and 14.3% of respondents, respectively) determine whether a company proceeds with developing and implementing an innovative technology.

Table 1 outlines the top five critical factors cited in determining the cost of and benefit for investment, which also included improving assurance of quality, global regulatory acceptability, and manufacturing flexibility (ranked first by 10.1%, 15.1%, and 18.5% of respondents, respectively). Table 1 shows the top five factors, the percent of respondents that ranked each factor first, and the percent of respondents who selected that factor as a top-five critical factor.

Respondents reported a range of business factors that led to the discontinuation of innovation projects, such as economic considerations, “fear of change,” levels of competence—including that of contract development manufacturing organizations (CDMOs)—and concern that short-term risks would incur delays in regulatory approvals. Certain improvements in manufacturing or analytics may be addressed directly by technical teams during development; however, decisions to invest in significant technological innovations are made at senior levels within organizations.

Regulatory Acceptability

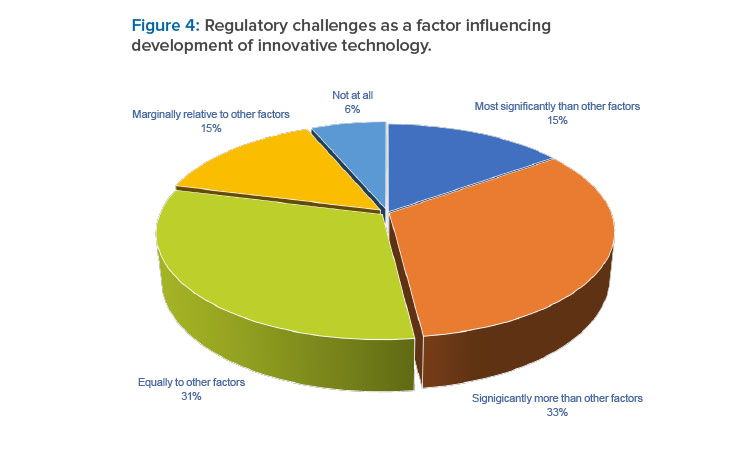

Regulatory challenges were reported as a significant factor influencing decisions to develop innovative technology. For a large proportion (48%) of respondents, these regulatory challenges were deemed most significant or significantly greater than other factors (see Figure 4). The top five concerns with regulatory acceptability are summarized in the first column in the following table (see Table 2).

The top three concerns with regulatory acceptability were:

- Challenges during application review: regulator adherence to conventional expectations that do not apply

- Lack of globally harmonized regulations

- Challenges during application review: regulator understanding of innovative technology

Responses to the questions in parts 2 and 3 confirm and amplify these concerns and provide additional specificity. For example, these concerns were confirmed in responses to the question, “Has your company/organization received divergent recommendations from different regulatory authorities regarding approval and implementation of innovative technologies and has this created a significant obstacle to implementing innovative technologies?”

A significant number of respondents (14 of 38 relevant responses) reported not receiving different recommendations from different regulatory authorities. However, a larger proportion of respondents (18 of 38) reported receiving different regulatory expectations from different regulatory authorities and provided many examples. Divergent regulatory expectations were reported in both assessment and inspection criteria. Examples were not limited to specific issues or technologies but reflected differences in regulatory expectations for innovative formulations and devices, processes, and analytical methods.

Of particular interest was the response that COVID-related medicines did not face regulatory differences . However, for other projects, such as new development approaches (quality by design) and less common manufacturing processes, differences in regulatory divergence that challenged implementation were observed. Understandably, healthcare leaders and regulatory authorities desperate for certain therapies to address significant threats to local health are prepared to be more flexible than they might be for conventional therapeutic products. The responses to this question imply that where technological innovations can improve therapeutic platforms a similar level of regulatory flexibility may be warranted.

| Factor | Ranked First (%) | Percent That Ranked Factor in Top Five |

|---|---|---|

| Long-term revenues | 33.6 | 89.1 |

| Manufacturing fl exibility | 18.5 | 95.0 |

| Global regulatory authority acceptability | 15.1 | 61.3 |

| Efficiency/productivity/minimizing SKUs | 14.3 | 90.7 |

| Quality assurance | 10.1 | 95.9 |

| Concern | Ranked First (%) | Percent That Ranked Factor in Top Five |

|---|---|---|

| Challenges during application review: regulator adherence to conventional expectations that do not apply | 29.6 | 90.0 |

| Lack of globally harmonized regulations and guidance | 19.7 | 67.7 |

| Challenges during application review: regulator understanding of innovative technology | 14.5 | 93.8 |

| Challenges during inspections | 8.6 | 41.4 |

| Lack of implementation of globally harmonized guidelines, i.e., ICH | 7.9 | 57.1 |

Similar findings were found in responses to the question, “Have cGMP inspections from multiple regulatory authorities resulted in increased quality/regulatory requirements, i.e., implementation of excessive or duplicative controls due to a lack of global regulatory harmonization?” A significant number of respondents (14 of 40 relevant responses) reported not receiving different recommendations from different regulatory authorities.

However, a larger proportion (20 of 40) of respondents reported receiving different regulatory expectations from different regulatory authorities and provided many examples. Although no direct correlation between divergent regulatory expectations and impact on specific innovative technology applications can be established, divergence implicitly leads to increased costs and potentially to delays in approvals.

Respondents indicated an overwhelming advantage in engaging with a regulatory authority innovation pathway—such as the FDA’s Emerging Technology Program (ETP)6 or Center for Biologics Evaluation and Research (CBER)’s Advanced Technologies Team (CATT) program,7 and the EMA’s Quality Innovation Group (QIG).8 However, a significant proportion of respondents also reported a relatively low level of engagement with these two groups: 22% for the FDA Emerging Technology Team (ETT) and 14.5% for the QIG.

Generally, respondents reported that meetings with a single regulatory authority were positive and appeared to reduce concerns. Engaging with the FDA’s ETT was reported as being very positive, and the EMA’s QIG was also mentioned as being helpful. However, specific respondent feedback indicated experiences where there were differences in outcomes from different regulatory authorities and disconnects between regulators reviewing the merits of innovative technologies with regulatory personnel involved in inspections.

Meeting with multiple regulatory authorities was reported in 13 of 41 relevant responses as not a problem. A larger proportion (21 of 41), however, did report meeting with multiple regulatory authorities as a challenge. This indicates that the possibility of different regulatory expectations or outcomes was a deterrent to the introduction of new technology. In addition, several respondents highlighted the burden associated with preparing for and conducting separate and multiple meetings. Relevant comments could be summarized as “there is lack of harmonization and meeting multiple agencies is burdensome.”

In summary, divergent global regulatory expectations, based on previous experience, are a primary concern and create a concomitant challenge for a majority of respondents:

- Agreements at meetings with senior-level regulators do not always lead to the same interpretation and acceptance by reviewers and inspectors that perform the assessments and inspect facilities.

- Engagements with multiple individual regulatory authorities frequently lead to different regulatory expectations for innovative technologies, i.e., separate specification acceptance criteria, different operational process parameters, and level of registered details.

- Engagements with multiple regulators is a logistical and resource-intensive burden and generally extends over a long time.

In addition, it was also mentioned that there is no regulatory pathway yet available in any market to facilitate the review and approval of chemistry manufacturing controls (CMC) platform technologies. These include, for example, analytical methods that are developed as applicable to multiple products.

Summary of Regulatory Challenges

According to respondents, these differences in regulatory authority expectations ultimately result in:

- Increases in regulatory commitments and resource costs

- Extended timescales due to delays to accommodate alternative or additional product development and characterization studies, which adversely impact estimated return on investment (ROI) benefits

- Increased compliance complexity and inventory management due to multiple control strategies for a single process or the most conservative control strategy governing a manufacturing process

When the level of uncertainty associated with divergent regulatory expectations is relatively high, the potential value of an innovation relative to its ROI becomes difficult to estimate and justify. According to many respondents, innovative approaches are subsequently postponed until the regulatory environment is more favorable or are simply terminated.

Indeed, the factors associated with perceived and real regulatory barriers by which decisions to proceed with an innovative technology are made, have led to a “it’s all too difficult, let’s not change” or “we don’t want to be the first to prosecute an innovative approach” mindset within the industry.

Summary of Regulatory Initiatives

Multiple initiatives focused on eliminating or reducing barriers to innovation are currently being addressed by several organizations. The following is a nonexclusive list of global initiatives; more explanation is given in the full survey report.2

United States

The US FDA established the Framework for Regulatory Advanced Manufacturing Evaluation (FRAME)9 and the ETP6 under the Center for Drug Evaluation and Research (CDER) and the CATT program7 under the CBER. It also established Project Orbis, a framework for concurrent submission and review of oncology products.10 The Duke Margolis Institute for Health Policy established the Advanced Manufacturing and Innovation Program.11

European Union and the UK

The EU EMA created the Innovation Task Force and QIG.8 The UK MHRA Innovation Office “provides free and confidential expert regulatory information, advice and guidance to organisations of all backgrounds and sizes based nationally or internationally.”12

Asia Pacific

Japan’s Pharmaceuticals and Medical Devices Agency established

the Innovative Manufacturing Technology working group (IMT-WG).13 Singapore Health Services Authority’s Innovation Office provides a “pilot to provide a conducive regulatory environment that will also support the development of the biomedical sector.”14

International

A number of guidelines and initiatives inform more globally: ICH guidelines;5 the International Coalition of Medicines Regulatory Authorities’ Pharmaceutical Quality Knowledge Management System (PQKMS) pilot programs;15 the WHO’s Collaborative Registration Procedure (CRA) using Stringent Regulatory Authorities’ (SRA) medicines evaluation;16 PIC/S’s harmonized Good Manufacturing Practice (GMP) standards;17 and the Access Consorti-um.18

What Did the Survey Confirm?

The survey confirmed that, in addition to developing innovative technology, the pharmaceutical industry is committed to continual improvement to ensure a reliable and sustainable supply chain, and to increase quality assurance and patient access to medicines globally. However, it is also clear from the survey feedback and responses that the current global regulatory environment poses a significant challenge to implementing continual improvement and innovative technologies.

Although several respondents indicated that regulatory pathways, like the ETP and CATT programs and the QIG, offer effective approaches that enable development and implementation of innovative technologies, globally divergent regulatory expectations remain a conspicuous concern and challenge. In fact, collective industry feedback clearly indicates that collaboration with regulatory authorities globally—either to revise existing regulatory options or introduce alternative global regulatory pathways—will facilitate the introduction, development, and implementation of innovative technology.

Survey Suggestions

The following suggestions summarize the survey recommendations.

- Establish an efficient system that connects regulatory authorities and fosters opportunities for companies and vendors to propose and establish innovations for global consideration, acceptance, and implementation.

- Align application review/assessment processes that cultivate a convergent approach to evaluate the merits of innovative technologies and produce a combined list of queries from global regulatory authorities.

- Adopt a single or limited GMP inspection schedule for assessing the implementation of innovative technologies per manufacturing facility (when required) in accordance with global inspection standards, i.e., PIC/s, and a focus on the requisite Pharmaceutical Quality Standards that support the innovative qualities of the product control strategy that is acceptable globally.

- Initiate global regulatory authority approvals that rely on mutual reliance/recognition. Several respondents emphasized that this conceptual approach, where appropriately established to reduce the chronic regulatory lag for global approval of post-approval changes associated with continual improvement, could serve as a key enabler to innovative technologies.

- Establish a predictable global regulatory authority review/

- assessment/inspection and approval schedule that ensures global supply chain reliability and patient access.

- Introduce a globally harmonized regulatory process to support review, inspection, and approval of platform technologies (e.g., analytical procedures) which may apply to multiple products.

A concerted globally aligned/integrated regulatory approach would undoubtedly increase the confidence within the industry to overcome regulatory risks and effectively enable the development of innovative technology. In addition, it would improve the industry’s commitment to continual improvement, cultivating the curation of a life cycle mindset. The unequivocal success with the introduction of the FDA’s ETP and CATT programs and the anticipated success of the EMA’s newer QIG program should serve as the basis for these recommended global regulatory approaches. It is worth noting the industry experience during the COVID-19 pandemic. The expedient regulatory assessment and distribution of vaccines could not have occurred without regulatory authority collaboration and mutual reliance.

Next Steps for the Enabling Global Pharmaceutical Innovation Initiative

Data and information from the survey—supported by in-depth discussion with several respondents who have direct experience developing, adopting, and implementing innovative technologies—will serve as the basis for case studies. This also provides opportunities for potential solutions, which could serve as substrate for engagement with regulatory assessors and inspectors globally.

ISPE’s Enabling Global Pharmaceutical Innovation Initiative Team will present proposals to multiple regulatory agencies at appropriate forums dedicated to advancing globally accepted regulatory approaches. These efforts are intended to promote practical incentives for both industry and regulatory authorities to address specific challenges to innovation and continual improvement initiatives.

The ISPE team will work with industry and equipment suppliers to understand the steps to introduce innovative technologies and develop a “points to consider document” of how to present these internally and externally to regulatory authorities.

About the Author

Acknowledgements

ISPE Team

Roger Nosal, Head of Global Regulatory Strategy and Submissions, NGT Biopharma Consultants (Initiative Chair)

Nina Cauchon, PhD, Director Regulatory Affairs – CMC, Amgen, Inc.

David Churchward, Head of Operations, Quality, Compliance and External Affairs, AstraZeneca

Jean-François Duliere, Regulatory Advisor, ISPE

John Lepore, PhD, Principal, JVL Pharma Consulting LLC

Maurice B. Parlane, Principal/Director, New Wayz Consulting Ltd./CBE Pty Ltd.

Chris Potter, PhD, CMC Pharmaceutical Consultant, ISPE Advisor (Initiative Rapporteur)

Alice Redmond, PhD, Chief Strategy Officer, CAI

Gregory Rullo, Executive Director, Regulatory Affairs – CMC, AstraZeneca

Hirofumi Suzuki, PhD, Product Supply Japan, Head of Project Supply Coordination, Bayer Yakuhin Ltd.

Timothy J.N. Watson, PhD, Vice President – Head of CMC Regulatory Affairs, Gilead Sciences, Inc.

Carol Winfield, Senior Director, Regulatory Operations, ISPE (Initiative Operational Project Manager)